Lloyd Cazes can help you receive up to $26,000 per employee with the Employee Retention Credit.

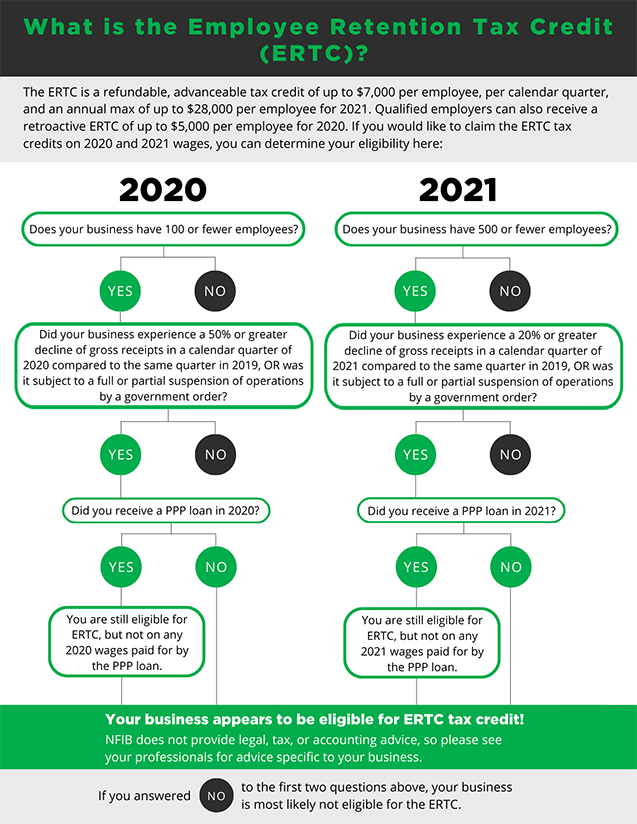

ERC is a stimulus program designed to help those businesses that were able to retain their employees during the Covid-19 pandemic. Established by the CARES Act, it is a refundable tax credit - that you can claim for your business. The ERC is available to both small and mid-sized businesses. It is based on qualified wages and healthcare paid to employees.

What we Offer:

- Thorough evaluation regarding your eligibility

- Comprehensive analysis of your claim

- Guidance on the claiming process and documentation

- Specific program expertise that a regular CPA or payroll processor might not be well-versed in

- Fast and smooth end-to-end process, from eligibility to claiming and receiving refunds

About The ERC Program

- Up to $26,000 per employee

- Available for 2020 and 3 quarters of 2021

- Qualify with decreased revenue or COVID event

- No limit on funding

- ERC is a refundable tax credit

- You can claim up to $5,000 per employee for 2020. For 2021, the credit can be up to $7,000 per employee per quarter.

We Specialize in Maximizing ERC for Small Businesses

- The program began on March 13th, 2020 and continues to September 30th, 2021 for eligible employers.

- You can apply for refunds for 2020 and 2021 after December 31st of this year, into 2022 and 2023. And potentially beyond then too.

- We have clients who received refunds only, and others that, in addition to refunds, also qualified to continue receiving ERC in every payroll they process through September 30, 2021, at about 30% of their payroll cost.

- We have clients who have received refunds from $100,000 to $6 million.

- Under the Consolidated Appropriations Act, businesses can now qualify for the ERC even if they already received a PPP loan. Note, though, that the ERC will only apply to wages not used for the PPP.

Your business qualifies for the ERC, if it falls under one of the following:

- A government authority required partial or full shutdown of your business during 2020 or 2021. This includes your operations being limited by commerce, inability to travel or restrictions of group meetings.

- Gross receipt reduction criteria is different for 2020 and 2021, but is measured against the current quarter as compared to 2019 pre-COVID amounts.

Tax Preparation & Bookeeping

Lloyd Cazes develops strategies for businesses and individuals to maximize retention of income and value of appreciated assets.

Learn more...Structuring Tax Deferred Transactions

We specialize in structuring tax deferred transactions on sale of capital assets, real state, stock, minerals and other valuable assets.

Learn more...FREE 30-Minute Consultation

We serve as an incubator for continual growth with efficient accounting and business management.

Learn more...Tax and Accounting News

News from Lloyd Cazes CPA: Is your portfolio diverse enough?

In today’s highly volatile economy, you must make sure you have a highly diversified portfolio to guard against losses while taking advantage of all positive […]

Lloyd Cazes CPA, QuickBooks Training

While QuickBooks® is user friendly most people still need QuickBooks training to effectively set up the accounting software, efficiently utilize appropriate features and ensure their […]

News from Lloyd Cazes CPA: Estate Planning in 2022

In recent years, Congress hasn’t made estate planning any easier with its ping-pong approach to the estate tax. The first — and most vexing — […]

New AICPA site highlights the value CPAs provide to small business owners

The AICPA announced the launch of a new site today, cpapowered.org, which emphasizes the value CPAs can provide to the nation’s 28 million small businesses […]